The University of the Philippines Open University-Faculty of Management and Development Studies (UPOU-FMDS) jointly organized with Sekiguchi Global Research Association (SGRA) of the Atsumi International Foundation (AISF) in collaboration with SUS 304 (Managing Sustainability Transitions) Students (2nd Semester, AY 2024-2025) conducted lectures for the 44th Sustainable Shared Growth Seminar on What’s Up with Ali: the UPOU Community Currency Pilot Study last 20 March 2025 via Zoom. The seminar was held in support of UN Sustainable Development Goals (SDGs) including Quality Education (SDG 4) and Partnerships for the Goals (SDG 17).

Chancellor Joane V. Serrano, Ph.D., the first speaker who spearheaded the project, reported the motivations, challenges, and milestones of implementing Alitaptap CC, an alternative currency designed to strengthen community exchange and engagement. Chancellor Serrano detailed the rationale behind setting up Ali CC as a means to foster local exchange and strengthen community engagement. The discussion outlined the journey of the initiative, from its analogue passbook phase to the transition into a digital passbook system—one of the study’s key milestones. The shift aimed to enhance usability and accessibility, and further introduced challenges in terms of onboarding and user adoption.

One of the central themes of the presentation was the difficulty in achieving consistent participation. Despite efforts to onboard new users, adoption rates remained low, with one onboarding session resulting in only a single participant. The reasons explored ranged from a lack of awareness to the need for stronger incentives and community involvement.

Several roadblocks to successful implementation were identified, including a period of inactivity between digitalization (April 2024) and the formation of the Alitaptap Facilitating Team (November 2024), which slowed user engagement, the absence of mass onboarding sessions, limiting the currency’s reach within the community, and the need for clearer governance structures to ensure sustainability and trust in the system. In response, Chancellor Serrano emphasized the importance of forming a Community Council to provide a more grassroots-led approach. She also highlighted the role of capacity-building activities for UPOU members, which could empower them to take on leadership roles in managing and expanding the community currency.

As the initiative moves into Phase 2, the Ali CC team continues to refine its approach, drawing insights from global models like Kenya’s Community Inclusion Currency. The discussion reinforced the potential of community currencies in fostering local economic resilience while emphasizing the need for sustained engagement and institutional support.

The lecture of Chancellor Serrano underscored both the promise and the challenges of community currency systems. While hurdles remain in user adoption and scalability, the initiative continues to evolve with renewed efforts in engagement, governance, and capacity-building. As Ali CC progresses, it holds the potential to serve as a model for similar initiatives in other communities, promoting localized economic resilience and financial inclusivity.

The second speaker, Dr. Ferdinand C. Maquito, a lecturer and faculty-in-charge of SUS 304 at the FMDS, led the discussion on the pilot study and emphasized the role of community currency (CC) in fostering sustainable shared growth. Inspired by a Japanese song and affectionately referred to as “Ali,” the currency represents engagement and collaboration within the community.

The Alitaptap initiative is designed around three core principles—Kalikasan (Environment), Katarungan (Equity), and Kaayusan (Efficiency)—which collectively aim to encourage ecological services, eliminate interest rates to reduce income disparity, and improve transactional efficiency. “The community currency allows members to trade goods and services outside of the traditional employment model, fostering a more inclusive economy,” Dr. Maquito explained.

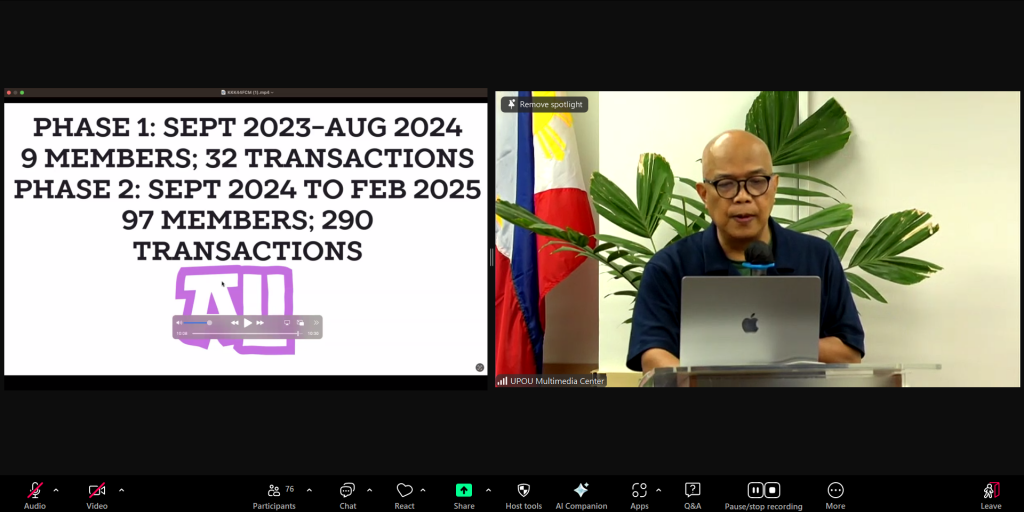

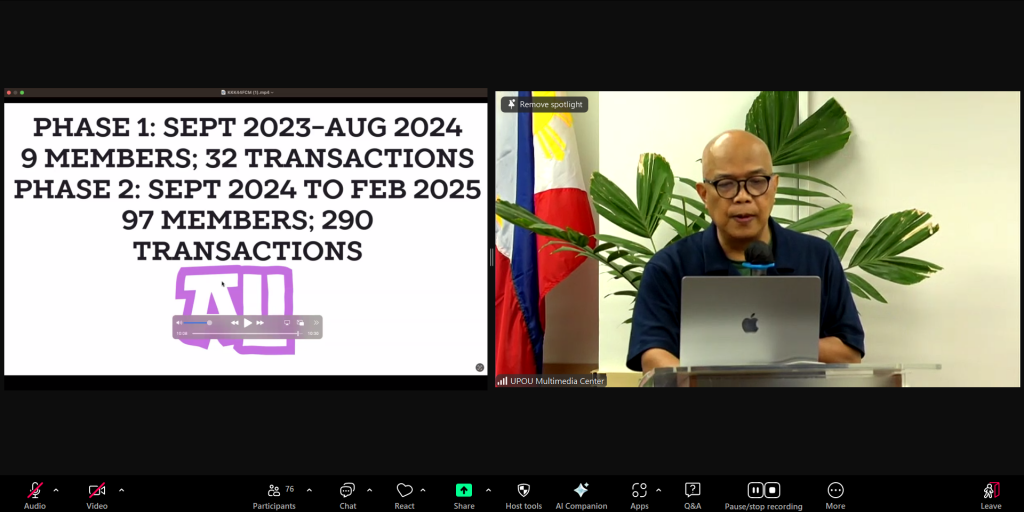

First launched in September 2023 using an analog passbook system, the project transitioned to a digital platform called Cyclos in April 2024. By February 2025, membership had grown to 97 participants, with 290 recorded transactions—marking a significant leap in adoption.

Moving forward, the discussion aims to strengthen member engagement by establishing a community council. This will ensure long-term participation and education about the benefits of CC. It ended with the goal to develop a hybrid economic ecosystem that bridges community currency with traditional monetary systems.

Lastly, Mr. Cesar Z. Luna, lecturer and faculty-in-charge in FMDS presented about the “Benchmarking the Philippine Alitaptap Community Currency with the Indonesian Dual Currency System: In Search of Inter-Ecosystem Synergies.” The presentation’s central question explored whether a synergy could exist between grassroots community currencies and mainstream financial systems. Mr. Luna and the Ali CC team hypothesized that a mutually reinforcing relationship—rather than a competitive or substitutional one—could enhance engagement and sustainability.

A key segment of his lecture focused on the success of Bali’s Nayahan Banjar currency, which operates alongside the Indonesian Rupiah. Unlike Ali CC, Bali’s system benefits from a strong community council (Banjar) that facilitates participatory governance and mandates community contributions in the form of time-based work. This approach ensures that residents actively engage in local projects, reinforcing both cultural identity and economic sustainability.

The discussion revealed several structural weaknesses in Ali CC that hinder its widespread adoption such as absence of a structured community council to oversee participation, voluntary participation, leading to inconsistent engagement, and lack of a clear unifying vision linking community currency use to broader sustainability goals. To address these gaps, Mr. Luna proposed the establishment of a community council similar to Bali’s Banjar, the introduction of mandatory participation in community-led initiatives, and a better-defined balance between Ali CC and fiat currency transactions.

Mr. Luna reinforced this sentiment, saying, “A currency is more than just a means of exchange; it reflects the values and priorities of a community. For Ali CC to succeed, it must align with what the UPOU community truly needs.” With these insights, Ali CC moves forward with renewed commitment, aiming to establish itself as a viable community currency that fosters economic sustainability and social cohesion.

The event ended with a Closing Remarks from Assoc. Prof. Finaflor F. Taylan DProfSt, RSW, the Dean of FMDS. Dean Taylan emphasized that community currencies, such as Alitaptap CCi used in UPOU, were more than just financial instruments. She described them as mechanisms for strengthening local networks, promoting collaboration, and empowering communities. According to Dean Taylan, these currencies redefined value beyond traditional economic systems by fostering shared commitments to sustainability. She also called on students, educators, and changemakers to take action—raising awareness, conducting research, and collaborating with local communities to expand the use of these currencies.

To end, Dean Taylan urged a shift in mindset, stressing that mainstreaming community currencies would require innovation, experimentation, and long-term commitment. The event reinforced UPOU’s dedication to exploring sustainable and inclusive economic models.

Written by: Dina Mae N. Rejano | Edited by: Noreen Dianne S. Alazada

Sustainable Development Goals

FMDS Socials